Vesting Period, Tether (USDT), Ethereum Classic (ETC)

Here is an article with a title that includes two of your requested cryptocurrencies:

“Crypto Frenzy: Unleashing the Power of Tether and etc Dooring Crypto Vesting Periods”

The Crypto Market Can Be Unpredictable, But One Thing Remains Constant – The Importance of Understanding How To Navigate its Twists and Turns. For Many Investors, This Means Being Aware of the Crypto Vesting Periods That Affect Their Holdings.

Tether (USDT) – The Stable Hedge

One cryptocurrency that stands out in the stable hedge category is tether (USDT). As a USDT-Based stablecoin, IT sacrifices of extremely low risk proposition to traders. Its pegged Value Ensures that its total supply remains Constant, Making it an Attractive Asset for Investors Seeking a Stable Store of Value.

Ethereum Classic (etc) – The Niche Crypto with Unmatched Performance

On the other hand, Ethereum Classic (etc) is a niche cryptocurrency that has garnered attention in recent years. Unlike Some Other Altcoins, etc Boasts Impressive Performance Metrics, Including A 10-Year High in Market Capitalization. With its focus on community-driven development and scalability improvements, etc has carved out a dedicated following among investors seeking alternative assets with real-world use cases.

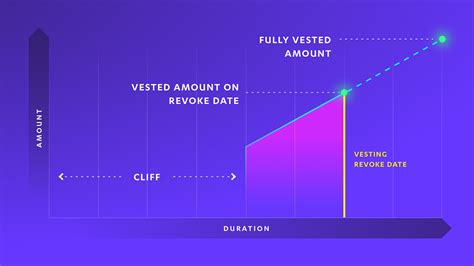

Unlocking Crypto Vesting Periods

So how do you prepare for the crypto fortress periods that await you? Here are some key consultations to keep in mind:

Tether (USDT) is an excellent choice-krypto fortress periods, as its stable pegged value ensures a low-risk proposition. Investors Can Lock in Gains and Ride Out Market Fluctuations.

Ethereum Classic (etc) : Ethereum Classic’s Performance-Driven Approach Makes It An Attractive Option For Investors Seeking Alternative Assets with Real-World use Cases. Its strong community backing and scalable infrastructure make it a compelling choice.

By understanding the crypto fortress periods that affect your holdings, you can better navigate the market and maximize your returns.