Relative Strength Index, ATH, Award

The Complete Guide to Understanding Cryptocurrency and the Relative Strength Index (RSI)

In today’s financial world, cryptocurrency has emerged as a new frontier for investment opportunities. The volatility and unpredictability of the market can make it difficult to navigate, even for experienced investors. However, with the right tools and techniques, you can gain an edge over your competitors and make informed decisions about your investments.

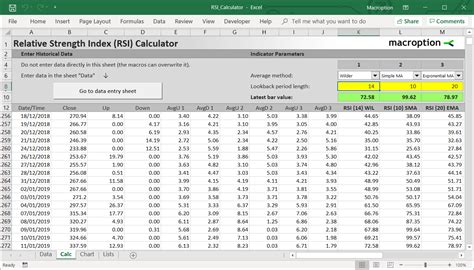

One popular tool used by traders and investors is the Relative Strength Index (RSI), a technical analysis indicator that helps identify overbought or oversold conditions in financial markets. In this article, we will delve into the world of cryptocurrencies and explore how you can use RSI as part of your investment strategy.

What is the Relative Strength Index (RSI)?

The Relative Strength Index (RSI) is a momentum indicator developed by J. Welles Wilder Jr. in the 1970s. It calculates the range of recent price movements to determine overbought or oversold conditions, allowing traders to make more informed decisions.

Here’s how it works:

- Calculate the average profit per unit price change.

- If profits are high compared to losses, the RSI is above 70.

- If losses are high compared to profits, the RSI is below 30.

- The RSI oscillates between 0 and 100, with higher values indicating overbought and lower values indicating oversold conditions.

Using the Relative Strength Index (RSI) When Investing in Cryptocurrencies

Now that you know how to calculate the RSI for your cryptocurrency investments, let’s explore some strategies for using this indicator effectively:

- Identify Overbought and Oversold Conditions: A high or low RSI can indicate a strong trend in cryptocurrencies. If the RSI is above 70, it may be time to consider selling or changing your investment strategy. On the other hand, if the RSI is below 30, it is likely a sign of strong buying momentum.

- Check for breakouts: When the RSI crosses above 50, it may mean that the trend has reversed and a breakout could lead to a significant price increase.

- Use RSI crosses as alerts

: Many trading platforms offer alerts when the RSI reaches certain levels or crosses/falls below a certain threshold. These alerts can be used to trigger buy or sell signals based on your investment strategy.

- Determine the trend direction: For example, a RSI above 50 and a downtrend indicate that the trend is likely to continue downward.

Using the Relative Strength Index (RSI) with Other Indicators

While the RSI is an excellent momentum indicator, using it in conjunction with other indicators can enhance your analysis and make more informed decisions. Here are some popular combinations:

- Stochastic Oscillator: The Stochastic Oscillator combines the RSI with a percentage, providing a more comprehensive picture of market conditions.

- Bollinger Bands: Bollinger Bands, another technical analysis tool, works with the RSI to identify support and resistance areas.

How to Choose the Right RSI Level

When using the Relative Strength Index (RSI), it is important to choose the right level to use as a reference point. Here are some general guidelines:

- Use the 20-period RSI: This period is considered the most commonly used period in technical analysis.

- Adapt to market conditions

: If you trade during times of high volatility, such as before major announcements or during cryptocurrency rallies, you may want to adjust your RSI levels accordingly.

결론

The Relative Strength Index (RSI) is a powerful tool in the world of cryptocurrency investing. If you understand how to use this indicator effectively and combine it with other technical analysis tools, you can make more informed decisions and potentially improve your return on investment.