Decentralized, exchange rate risk, API trading

Here is a potential article on the topic of crypto, decentralized exchange rate risk, and API trading:

“Navigating the Volatile World of Cryptocurrency Exchanges: Decentralized Exchange Rate Risk Management through API Trading”

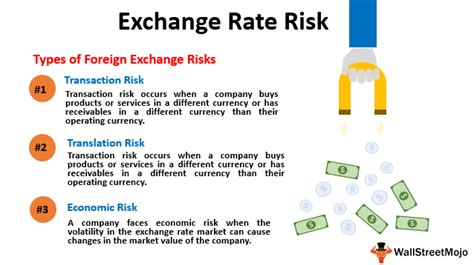

In recent years, cryptocurrencies have experienced significant price fluctuations, making it essential for traders to understand the risks associated with exchanging cryptocurrencies. One of the primary concerns is exchange rate risk, which can result in substantial losses if not managed properly. This article will explore the concept of decentralized exchange rate risk and provide insights on how API trading can help mitigate these risks.

Decentralized Exchange Rate Risk: A Threat to Cryptocurrency Trading

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operates independently, without a central authority controlling transactions or exchange rates. While DEXs offer numerous benefits, such as faster transaction times and lower fees, they also introduce a new set of risks, including exchange rate risk.

Exchange rate risk occurs when the value of a cryptocurrency fluctuates in response to changes in market demand, interest rates, or other economic factors. When a trader buys a cryptocurrency at a low price on one DEX and sells it at a higher price on another DEX, they may be exposed to the risks of exchange rate fluctuations.

API Trading: A Solution for Decentralized Exchange Rate Risk Management

API (Application Programming Interface) trading is a technology that enables traders to execute trades in real-time using APIs from multiple exchanges. By leveraging API trading, traders can minimize their exposure to exchange rate risk and optimize their trading strategies.

Here are some ways API trading can help with decentralized exchange rate risk management:

- Improved Execution Speed

: API trading allows for faster execution of trades compared to traditional exchange-based methods.

- Reduced Risk of Exchange Rate Fluctuations: By executing trades in real-time, traders can better manage the risks associated with exchange rate fluctuations.

- Increased Transparency: APIs provide detailed information on trade execution, allowing traders to monitor their positions and make informed decisions.

Best Practices for API Trading

To get the most out of API trading and minimize its risks, follow these best practices:

- Choose a Reliable Exchange: Select an exchange with a strong reputation, robust security measures, and a solid network infrastructure.

- Understand the Fees

: Be aware of any fees associated with using APIs from multiple exchanges.

- Monitor Trade Execution: Continuously monitor trade execution to ensure that trades are being executed efficiently and securely.

Conclusion

Decentralized exchange rate risk is a significant concern for traders who engage in cryptocurrency trading. By leveraging API trading, traders can minimize their exposure to exchange rate fluctuations and optimize their trading strategies. However, it’s essential to understand the risks associated with decentralized exchanges and implement best practices to manage these risks effectively.

By doing so, traders can navigate the volatile world of cryptocurrency exchanges and achieve greater success in their API-trading endeavours.