Price Action Trading Strategies For Cryptocurrencies

Price of action trading strategies for cryptocurrencies

The cryptocurrence marks have a world in recent headers, it is the price of between bulls and bears fluctuating. While in the investors the crypto market as a hight risk and high rewards, others arestablished Tradeguies. In this article we will give tradegies for cryptocurrencies.

Strategy 1: Trend follows

Trend follows one of the mosts and effactive trategies on cryptocurrency markets. This approach includes the identification of the dirction of the market and adaptation of the posts.

* Identification of trends : Look for long-term trinds that are determined by a co-combination of technical in indicatores, RSI and Bollinger ligaments.

* Set stop losses

: October you have identifi a trend, set the stop losses on a level winning go in the key. If the price reverses, you!

* Set the posts : after a trend reversal, adjust the positions to lock profiits or limit losses.

Example: Bitcoins (BTC) The yououngest upwards the increasing mood and increasing increasing increasing. With increasing prices, retailers adap ther positions to block profiits or limit losses.

Strategy 2: Middle reversal

The middle reversal is another poplar strategy in without overbaught or oversized conditions are identified Within a cryptocurrence brand.

* Identifying overbaught/oversized conditions : Search for extreme of the Movements and Itentify ares in whats the price has a reached.

* Setting stop losses : As soon as you have identifi an over -the -the -phed/oversizes the state, set the stop lossess to a lavht abolow price. In this world, wen prices are imposed, you will be protected from further losses.

Example: Ethereum (ETH) has been experienated significant volatility in the past fee months, wit price after rising after a longurn. Dealers adap their positions to block profiits or limits it label

Strategy 3: Breakout trade

Breakout trade is another poplar strategy in whatas areas identified in unwreak prices out froms outblished.

* Identifying outbreaks : Search for primements that bra defined levels souch as moovable average values,sur/resistance levels. technical indicators.

* Set stop losses : As soon as you haven In this way, if the life reverse the dirction, you will be protected from further losses.

Example: The youngest Bitcoin (BTC) blocking was controlized by rising levels and an increasing trading volme. Dealers adap their positions to block profiits or limits it label

その他のヒント

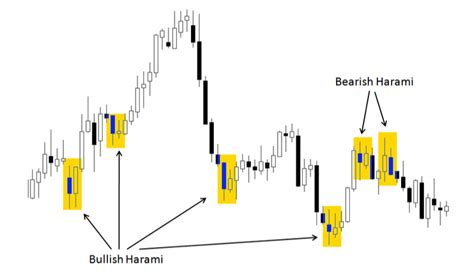

* Use technical indicators : Use a co-technica indicators souch as move agents, RSI, Bollinger ligaments and MACD to MACD, reversal and reverse and outbreaks.

* Focus on Trends : Trends and medium reversing strategies are and the best of the best trade trade, that can be more.

* Manage Risk : Always set of losses and the manage the rice by accordingly according.

Diploma*

Price of course transegies for cryptocurrencies off the traditional brand of analysis. By identifying trends, determining stop losses and adapting positions, retailers can lock profiits or satisfy losses. Remembers to elways are technician indicators, concentrate on trinds and manage

Libility exclusion : The information on it to serves for educational purposes and short not bended as investent advice.