Miner, Market Correlation, Perpetual futures

“Crypto, Mining, Market correlation, future eternal: understanding of the complex relationship”

The world of cryptocurrencies has grown exponentially in recent years and millions of investors have been exchanging on platforms such as Coinbase, Binance and Kraken. One of the most important drivers of this wave of popularity is the appearance of miners who use special hardware to validate transactions on public blocks.

Mining plays a decisive role in maintaining the integrity and safety of cryptocurrency networks, as they are responsible for the resolution of complex mathematical problems that promote the network supply and transactions control. In exchange for their efforts, the miners are rewarded with freshly free coins or tokens, which have been historically fixed to traditional Fiat currencies at a historically fixed exchange rate.

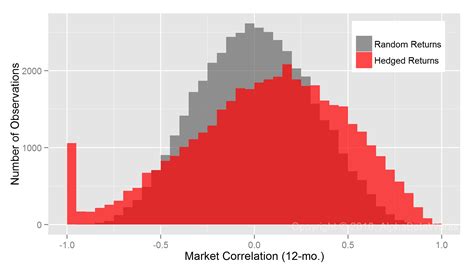

However, the report between encryption and mining activities has become increasingly correlated in recent years. As the mining strength increases, it can lead to an increase in the encrypted demand, which can increase price prices. On the contrary, when miners are slowed down by greater competition or supply chain disorders, prices are generally reduced.

This correlation is limited not only to traditional cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The price of other Altcoin, such as the price of the Stabretain, is also increasingly correlated to the miner’s activities. For example, the Litecoin price (LTC) was strictly related to mining performance in 2018 when the algorithm was updated to increase the block reward.

But what does this mean for investors? Although correlation can be a powerful force in increasing prices, it is also essential to understand that past performance do not necessarily indicate future results. In fact, some Altcoins have experienced a significant price reduction despite the greater activity of the miner, such as the collapse of the earth (moon) and the cosmos (atom).

Permanent contracts, on the other hand, offer investors a unique opportunity to think about cryptocurrency prices without actually buying or keeping physical activities. These contracts allow merchants to close profits at a fixed price, regardless of market fluctuations.

Future eternal are exchanged on a centralized platform such as group CME and IG markets, where they are often related to traditional financial markets such as the S&P 500 index. This means that when prices for eternal future increase, it can bring to more prices high devices in the largest market.

They are the key to:

- Cryptocurrency miners are increasingly correlated with cryptocurrency prices : the demand and supply rate will increase when mining performance increases, leading to a rapid increase or fall.

2

- The correlation of the market is not always reliable

: although the correlation can increase prices, past services do not guarantee future results.

- Stablecoins were increasingly correlated with mining power : the growth of cryptocurrencies supported by Stabercain has attracted greater interest in eternal contracts.

Investors guide:

If you do not know the investment of the cryptocurrency, it is essential to understand the relationship between mining activities and price fluctuations. Here are some socket key:

- Monitor the news and trends of the market relating to mining and cryptocurrency prices.

- Set a risk management strategy that includes an increase in potential drop in prices or miners.

- Take into consideration the use of eternal contracts as a speculative tool, but be aware of the risks relating to related markets.

By understanding cryptographic miners, market correlation and Eternal Futures relationship, investors can make decisions more well based on their investments.