Understanding The Risks Of Trading With Tron (TRX) And Market Dynamics

Understanding of the risks of trading with Tron (TRX) and market Dynamics

The world of cryptocurrency trading has grown exponentially in recent years, with many investors who have exploited the potential of high yields. Among the various cryptocurrencies, it stands out as an alternative leader to traditional Fiat currencies: Tron (Tron). As a decentralized platform that allows safe, fast and free transactions, Tron has gained significant traction among traders. However, before immersing yourself in the world of TRX trading, it is essential to understand the risks involved.

What is Tron?

Tron is an Open Source platform, based on Blockchain that allows developers to create, distribute and manage intelligent contracts on its network. The native cryptocurrency of the platform, TRX (previously known as Tron), is used for various purposes, including payment transactions, picket and governance. TRX has a limited supply of 21 billion coins and is anchored to the US dollar.

MARKING DYNAMIC: A high risk environment

The cryptocurrency market is intrinsically volatile, with prices that flow rapidly in response to the feeling of the market, regulatory changes and other factors. The dynamics of the Tron market are no exception:

* Volatility : TRX has experienced significant price oscillations, often in a single day of trading.

* Liquidity : TRX liquidity on exchanges is relatively low, making it difficult for traders to buy or sell the coin at favorable prices.

* Regulatory uncertainty : The regulatory environment surrounding cryptocurrencies is still evolving and subject to changes. This uncertainty can affect the trust of investors and the feeling of the market.

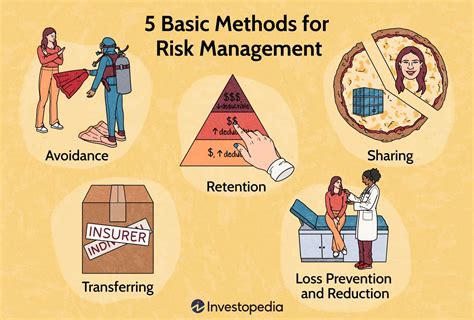

Risks associated with trading with Tron (TRX)

While Trx offers a series of advantages, including fast transaction times and low taxes, the following risks should be considered:

* MARKING RISK : The cryptocurrency market is highly susceptible to prices oscillations, which can involve significant losses if not correctly managed.

* Risks of regulatory : changes in policies or regulatory laws that regulate cryptocurrencies can affect investors and market feeling.

* Safety risks : The decentralized nature of blockchain technology makes it vulnerable to hacking and other safety threats.

* Risks of liquidity

: the low liquidity on exchanges can limit the possibility of purchasing or selling TRX at favorable prices.

Investment strategies for Tron (TRX)

To mitigate these risks, investors should consider the following strategies:

* Media costs from one dollar : investing a fixed amount of money at regular intervals to reduce the impact of market volatility.

* Position sizing : Limit the size of the trading to avoid significant losses in case of a single trade that goes against you.

* Arrest orders : set up arrest orders to limit potential losses if the price moves against you.

* diversification : spread investments in more cryptocurrencies and activities classes to reduce exposure to a certain market or safety.

Kesimpulan

Trading with Tron (TRX) involves significant risks, including market volatility, regulatory uncertainty, threats to safety and liquidity risks. While Trx offers a series of advantages, investors should be aware of these risks before deciding to trade on the platform. By understanding the dynamics of the market and implementing effective investment strategies, traders can minimize their losses and maximize potential earnings.

Disclaimer

This article is only for information purposes and should not be considered as investment advice. Tron (TRX) is a relatively new cryptocurrency with limited historical data and its performance could flow significantly in the future. Investors should consult financial consultants before making any investment decision.