Market Psychology And Its Impact On Cardano (ADA) Prices

** Psychology of cryptocurrenc

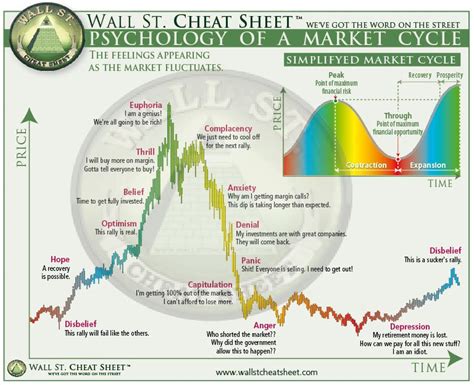

The world of cryptocurrencies has received considerable attention in recent years, and many investors have come to space due to high yields. However, beyond numbers and technical analysis, there is an impressive phenomenon in the game – market psychology. The way people perceive and react to the cryptocurrency markets can be directly influenced by the prices of each device, such as Cardano (ADA). In this article, we are immersed in the psychological aspects of cryptocurrency trade and examine how market emotions affect the prices of ADA.

Market Psychology: The good feeling

Market psychology refers to investors emotional about their financial decisions. This includes various factors, including emotions, attitudes and behavior that affect investment decisions. In the context of cryptocurrencies, market psychology can manifest itself as a “good feeling” effect, where investors become too optimistic about the growth potential of the device.

This phenomenon is often referred to as “emotion of mass” or “investor confidence”. When a large number of investors buy a device, you can create a self -enhancing cycle that increases prices. The reason for this is that confident investors are more likely to invest in the asset, which attracts even more investors and results in further price increases.

Role of News and Events

News and events play a decisive role in developing market emotions. Cryptocurrencies such as Bitcoin (BTC) and ETHEREUM (ETH) were historically highly influenced by senior hackers, regulatory changes and other significant announcements. These events can create a rippling effect, influencing the general market atmosphere.

Cardano (ADA), as an alternative cryptocurrency with its own unique qualities, has experienced the share of communications. In 2017, the project drew attention to disturbing traditional intelligent contract systems. This led to increased interest and investment in the ADA, which in turn increased prices.

The importance of Fomo (fear of deficiency)

One of the most significant psychological drivers of market behavior is Fomo – the fear of skipping the opportunity to invest in a particular asset. When investors believe that the value of an asset is increasing, they can put pressure on purchase instead of waiting for potential profits later.

This phenomenon is particularly pronounced in the cryptocurrencies, where prices can fluctuate quickly. The “Price Momentum” effect, where prices tend to go up and then turn it back when the crowd stops buying-a classic example of a Fomo-controlled market behavior.

Effect on ADA prices

So, how does market psychology psychology affect the prices of ADA? By creating an environment where investors feel optimistic about the device’s growth potential, Cardano (ADA) may experience increased demand and subsequent price increases. In contrast, when investor emotions become a bear or a Fomo-leader, prices may fall.

Historically, Cardano’s price movements were influenced by various events, including the following:

- Regulatory clarity : Permissions of regulatory bodies, such as US treasury cryptocurrencies, can create security and trust in the ADA.

2.

- Market Emotions : As mentioned earlier, mass psychology plays an important role in developing market emotions. A strong “feeling” effect can increase prices.

Case Study: The price increase of 2017

In order to illustrate the effects of market psychology on prices, we will look at the dramatic price increase in 2017.