Tether (USDT) And Its Role In The Crypto Market

Rise USDT: Unlocking a new era for cryptocurrency trade

In a huge and fast -developed cryptocurrency world, one property appeared as the main player, affecting market trends and landscape design. Check out USDT, tying, also known as USDT (Tether USD), a popular cryptocurrency that attracted the attention of the trader, investors and market participants. In this article, we will enter the USDT in the world, exploring its role in the cryptographic market, history and what makes it attractive to property for traders.

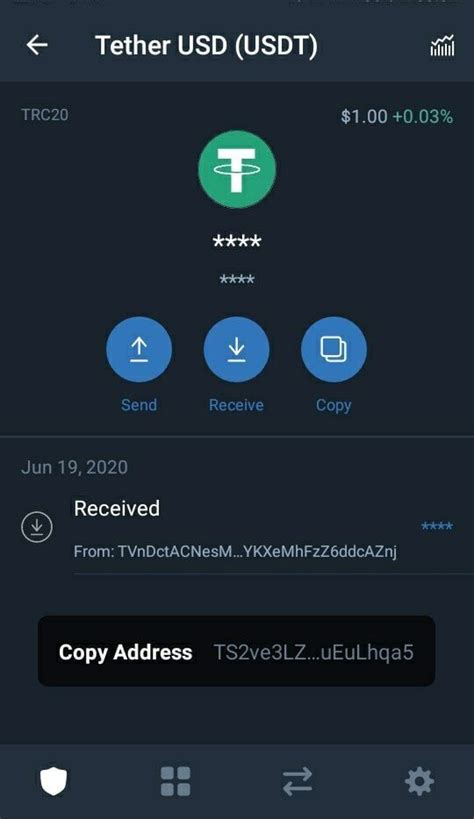

What is the tie (USDT)?

Tether (USDT) is a stable type of cryptocurrency, which aims to maintain a stable value compared to traditional currencies such as the US dollar. His genesis dates back to 2014, when the popular cryptocurrency stock exchange Bitfinex launched the first stable quantity by attracting the USD.

How does it work?

Tether (USDT) is linked to the US dollar at a fixed rate of 1: 1, ensuring that its value remains unchanged. This means that if you have USDT, you can in principle buy or sell dollars with equal amounts of connections without worrying about the fluctuations on the market.

To achieve this stability, Tether uses a sophisticated algorite procedure that includes different property such as gold and other goods. This ensures that the value of the connection remains consistent and does not affect the changes in the market.

Why is USDT so popular?

USDT popularity can be associated with several factors:

- Stability : As mentioned above, her related relationship with the US dollar provides a stable environmental environment and investment.

- Extensive adoption : Tether has widely accepted a variety of exchanges, including major such as Bitfinex, Binance and Coinbase.

3

Low Transaction Fees : Compared to other cryptocurrencies, low transactions tied makes it an attractive opportunity for merchants and investors looking for faster and cheaper transactions.

- Legislative Clarity : USDT is a relatively stable asset class that has led to increased regulatory clarity and support for the authorities worldwide.

Impact on the market

The presence of USDT in the market has significantly influenced its role and influence:

1

Increased trade volume : The introduction of the connection (USDT) recorded an increase in trade volume on various stock exchanges.

- Higher liquidity : With a stable asset class, merchants can use greater liquidity in the stock market, increasing their ability to buy or sell cryptocurrency at favorable prices.

3

Market mood : USDT stability has contributed to reduced market volatility by facilitating crypto market navigation investors.

Trends and influence on cryptocurrency market

USDT growth has a significant consequence of a wider cryptocurrency market:

1

Stableoins as a class : Success (USDT) showed that stable koins can be more than just active class; They can also serve as a bridge between traditional currencies and cryptocurrency.

- Legislative Clarity : Since regulatory authorities around the world are beginning to recognize the possible benefits and risks associated with Stabecoin, it can increase this property and support.

3

Market Structure

: The emergence of USDT has caused changes in market structures, such as increasing demand for trading platforms based on stable and reduced speculation on traditional currencies.

Kesimpulan

The USDT (attraction) appeared as a chief player in the cryptocurrency market, ensuring stability, liquidity and low transaction fees that attracted the attention of merchants and investors. His role in the development and impact of market trends on law emphasizes his importance in the world, which quickly develops currency cryptocurrency.

As the landscape continues to evolve, the presence of the USDT will undoubtedly play a crucial role in determining the market for the market.