How To Analyze Trading Volume For Market Opportunities

Title: Market Option Unlock with Cryptocurrency Trade Volume Analysis

Introduction

Cryptocurrency has paid considerable attention in recent years, and trade with them has become a profitable risk for many investors. While the cryptocurrency market is known for its volatility, analysis of trade can provide a valuable insight into the market. In this article, we will study how to analyze the volume of trade to identify potential buying and selling options.

** What is the volume of trade?

The volume of trade refers to the total number of units in a specified cryptocurrency market for a specified period. It measures the demand for active and provides an indication of its price movement. High sales may indicate strong buying percentage, while low volume may indicate sales or market fatigue.

** Why analyze the volume of trade?

Trade volume analysis offers several benefits:

1

Market mood : high trade volume often correlates with a positive market mood, suggesting that active is in demand.

- Price stability : Low trade may indicate price instability, which may indicate excessive supply or overproduction.

3

Risk Management : Trade analysis helps traders assess the potential risks and adjust their positions accordingly.

Key indicators to analyze

When analyzing market opportunities, consider the following key indicators:

1

daily trade : The average daily trade volumes are very important to understand the mood of the market. The high average daily volume may indicate a strong purchase interest.

- Short term volatility : Short -term volatility (eg 7-14 days) is more important than long -term trends. Analyze short -term changes in trade to identify potential price movements.

3

Weekends and Holidays

: Trade can be on weekends and holidays, as there are fewer traders in the markets.

- Volume Correlations

: Analyze correlations between different cryptocurrencies or asset classes to identify possible market opportunities.

Tools and Techniques

Use the following tools and techniques to effectively analyze the volume of trade:

1

cryptocurrency API : Use API tools such as Cryptocompare, CoinMarketcap or Binance API to access trading data.

2

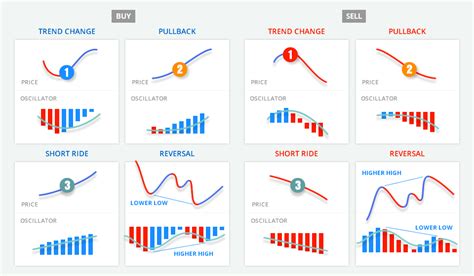

Technical indicators : Apply technical indicators such as the relative strength index (RSI), changing the average convergence deviation (MacD) and Bollinger bands to identify trends and models.

3

Chart Analysis : Analyze chart patterns and trends using a variety of time shots such as 1 minute, 15 minutes or daily charts.

Screenplay Example

Let’s say you are a trader looking for opportunities on the Bitcoin market. Over the past few weeks you are analyzing trade volus and noticing that:

- Daily sales have increased by 20%over the last two weeks.

- Short term volatility (7-14 days) is the highest, pointing to strong price movements.

- Volume correlations indicate a high correlation between Bitcoin and other cryptocurrencies on the market.

Based on these indicators, you may consider the following trading options:

1

Buy Bitcoin, as the volume increases : If trading increases by 20%within two weeks, it could indicate a strong buying interest rate on Bitcoin.

- For sale Ethereum with reduced volume : And vice versa, if trade decreases or remains flat, this may indicate the sale of Ethereum pressure.

Conclusión

Trade analysis is an essential tool for identifying market opportunities in the cryptocurrency market. Understanding the main indicators using technical and diagram analysis tools and using risk management strategies, traders can make conscious decisions on buying and selling assets. Remember to maintain modern market trends and adjust your approach as needed.