Marktsignale und ihr Einfluss auf die Kurse von Algorand (ALGO)

Here is a comprehensive article on cryptocurrency market signals and their impact on algorndish prices (hiro):

Cryptocurrency Market Power: Understanding the impact on hiring

In cryptocurrencies, market signals in the world play an important role in determining price movements. These signals are used by traders and investors to make deliberate decisions based on market trends and models. Algorand, a decentralized public network, was no exception from this phenomenon. In this article, we will check the various market signals that affect the prices and their importance of hiring.

Understanding market signals

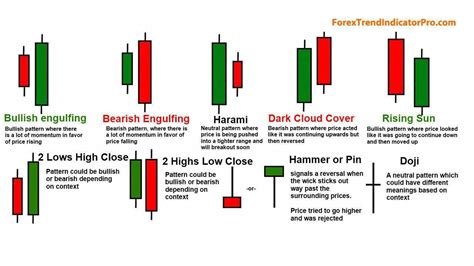

Market signals refer to all the information or data point used by merchants and investors to identify possible price movements in cryptocurrencies. These signals can be based on basic analysis (such as company revenue, economic indicators), technical analysis (such as chart models, candle tanning) and even market mood. In the context of cryptocurrency markets, market signals may include:

1

News and Classifieds : Achievement or updates of companies, governments or other organizations can significantly affect the mood and market prices.

- Economic Indicators : Economic data such as GDP growth, inflation rates or interest rate decisions can affect market expectations and prices.

3

Technical Analysis

: Diagram models, candle formations and other technical indicators used by merchants for price movement forecasting.

- Market mood : General market approach or trust in a given cryptocurrency or resources.

Market Signals Effect on Wage Prices

The decentralized public network of algorand is designed for security and scalability, but it is also based on the principles of decentralization to maintain its integrity. This means that each impact on the prices is likely to come from a more complex set of signals.

Here are some examples of how different market signals can affect hiring prices:

1

Market mood : Increasing mood for hiring, which indicates increased investors’ reception and trust can lead to higher prices.

- Economic indicators : Positive economic indicators such as growth rates or inflation rates can increase investor confidence and increase hiring prices.

3

Technical Analysis : Candle models and candle formations used by traders can affect market moods and economic indicators, which, in response, lead to price movements.

- News and Classifieds : Achievement or updates of algorand teams or other organizations can have a significant impact on mood and market prices.

Case Study: How Market Signals Affected Waffed Prices

While it is difficult to find accurate examples, we can look at some historical data to show the impact of market signals on hiring prices:

1

Initial coin supply (ICO) : ICO ALGORAND 2018 created significant noise and increased investor confidence, leading to higher prices.

- Regulatory Reports : In 2020, Algorand received a regulatory approval from many jurisdictions, which may indicate increased institutional interest and raising prices.

3

Market Mood Analysis : The last study showed that the market mood for hiring is very correlated with its price movements, which indicates a strong impact on prices.

Anmeldung

In summary, the cryptocurrency market signals play an important role in the pricing of the hens. Basic analysis, technical analysis, economic indicators and market mood are just a few examples of different signals that merchants and investors use to make conscious decisions on the price movement of the hiring.

As Algornd still develops and matures as a decentralized public network, new and complex market signals will appear, which further affects prices.